Buy Now Pay Later Aggregator

Buy Now Pay Later is a service that allows consumers to shop online and place and receive orders while paying for them later.

Challenge

The BNPL space is experiencing accelerated growth. BNPL has burst onto the scene. And is set to continue to grow in the coming years, potentially rivalling credit cards and digital wallets.

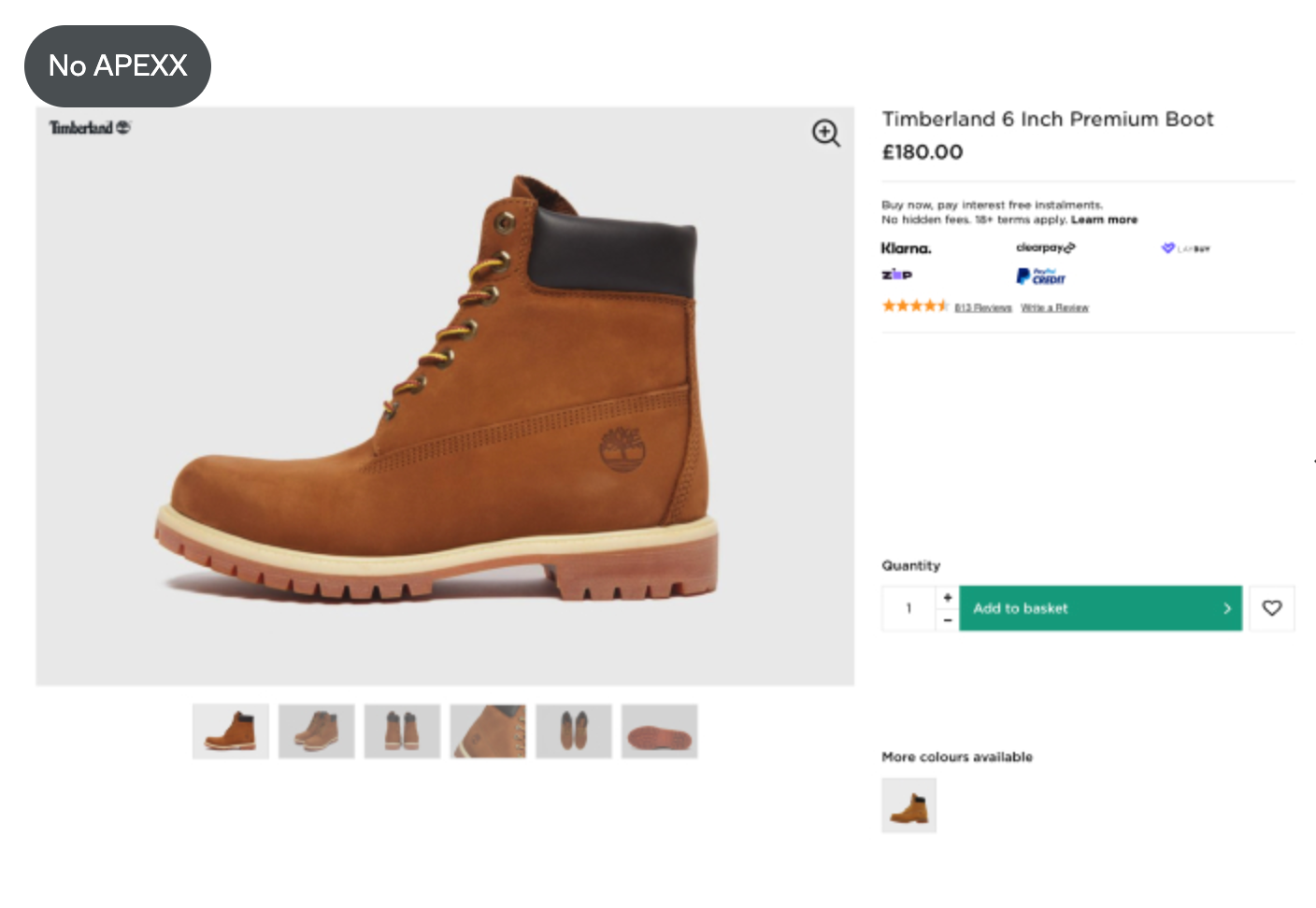

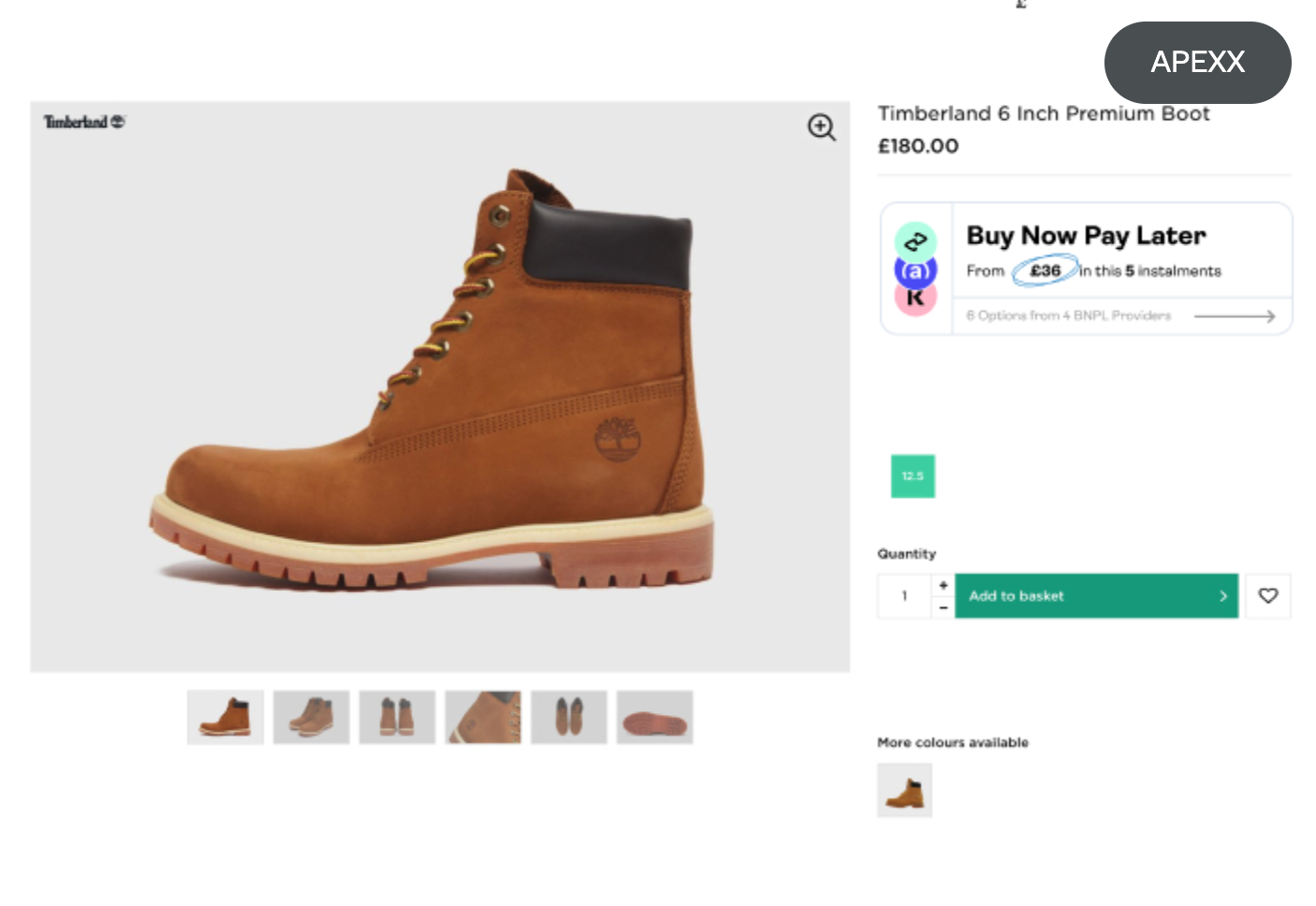

But the appearance of BNPL products is messy and unclear. We want to arrange and simplify the user experience of all BNPL market around the globe.

But the appearance of BNPL products is messy and unclear. We want to arrange and simplify the user experience of all BNPL market around the globe.

it’s a Fintech product, be ready for many numbers 🙂

Market Landscape

BNPL has been the fastest-growing online “payment method” globally for a second year running. Research shows that merchants can increase their conversion rates by 20% to 30% with a BNPL. Lending is predicted to hit a value of $114bn by 2024.

56%

Of consumers in the US used a form of BNPL in 2021.

85%

Growth in user base in 15 months.

62%

Of BNPL users say BNPL will replace credit cards.

3.8

The average number of items users currently pay in instalments.

How do we know that customers need multiple BNPL solutions?

As a merchant, if you are not offering various solutions you are simply missing out on millions of consumers:

82%

Of Consumers Prefer Multiple BNPL Options

88%

Of Consumers Said They Would Only Transact If Multiple Options

2%

Consumer Crossover Between BNPL Solutions

15%

Increase in Revenue For Merchants Offering Multiple Solutions

My role

Maintain all aspects of product design. Create prototypes for different concepts. Support the MVP development. Work with analytics to check the functionality of ideas.

Exploring the problem / Surveys

Here are the top pain points from our top B2B customers (Merchants) about the BNPLs integrations:

Exploring the problem / Surveys

We asked more than 10 top merchants in the UK why they are interested in the multiple BNPLs. Let’s look at their answers:

Consumer Demand

These days, significant consumer demand forces merchants to offer competing BNPL products.

Vertical Specialists

Some BNPLs specialise in specific verticals, ensuring more payment options for consumers and better conversion rates for merchants.

Consumer acquisition

Some BNPLs specialise in specific verticals, ensuring more payment options for consumers better conversion rates for merchants.

Product Variance / ATV

Each provider offers multiple products under the BNPL umbrella, including DBTs, DDs, financing etc.

Cost Comparison

A/B Testing: Merchants adopt multiple BNPLs for cost & performance comparison.

B2C User Portrait

A 2021 survey of 2,000 respondents found that 55.8% used a BNPL service. This penetration rate had increased by around 50% since a July 2020 survey.

Broken down, 62.8% of males surveyed had used a BNPL service. At the same time, 51.36% of females claimed to have used a BNPL service at some stage.

The 18-34 years age group are 3x more likely to use BNPL regularly than 55+ years. A 2021 survey revealed that 16% of 18 to 34-year-olds use BNPL.

Broken down, 62.8% of males surveyed had used a BNPL service. At the same time, 51.36% of females claimed to have used a BNPL service at some stage.

The 18-34 years age group are 3x more likely to use BNPL regularly than 55+ years. A 2021 survey revealed that 16% of 18 to 34-year-olds use BNPL.

We need a clean, modern, and simple design solution for our BNPL aggregator based on the data above. The nearest reference will be the solutions from the top BNPL players themselves. They have invested significant effort to adapt their design to the right audience.

Ideation / Wireframe

Figma Jam helps us discuss and adjust many things during the wireframe process with the internal team. We play with the layout and change the steps’ order and core logic. It’s still a life process:

Architecture / UX Analysis

BNPL aggregation platform designed from the ground up as a single access point to the World’s largest BNPLs. So the fundamental logic is to combine the offers for the final user properly.

Here is the introductory offer construction:

Here is the introductory offer construction:

All cards are transferred to the design system with parameters for fast prototyping:

We can quickly combine hundreds of different variations of offers for other countries right in the Figma prototype.

Approval probability is an integral part of our concept, but we do not interrupt the user from the main flow; we offer a probability check as a parallel flow.

Approval probability is an integral part of our concept, but we do not interrupt the user from the main flow; we offer a probability check as a parallel flow.

The next important part of the flow is an overview of the future payments schedule. During our tests and research, we combined different versions of it. We are still A/B testing variants for it, but these two are the most attractive and simple for users:

The final part of the flow will be a success screen and transaction cascading in case of approval failure. So it’s pretty straightforward to redirect back to the store if the the the marketing has been successful. But in case of failure, we have an excellent solution for users to apply for other providers.

It’s an intelligent cascading because we already had this provider on the previous steps, and we can quickly adjust the probability for the next try.

FINAL INTERFACE

Portal Interface For Merchants

He has a wonderful merchant portal in APEXX for all settings and analytics that you can only imagine. You can read about it in this product case. We planned a dedicated section for the BNPLs. It would cover the basic analytics, like Acceptance Rate, Total Sales, Sales Geography, etc.

This real-time data helps our clients with P1 (Speed of Change). They can easily monitor all trends connected with BNPL.

This real-time data helps our clients with P1 (Speed of Change). They can easily monitor all trends connected with BNPL.

One of the core features of analytics is splitting the data by providers

And portal helps with the P2 (Complicated Integrations) as well. At the moment, all the merchants who want to connect a new provider for their store need a tone of action done. The APIs are different as well as documentation from provider to provider, dedicate a dev team to connect all of them is a nightmare. We offer a unique way to connect new providers with just one switch.

We add an auto-adoption of your existing connected APIs (Klarna, for example) to the new provider effortless. It’s done with a simple UI switch from the settings that will start an onboarding process.

Provider’s setting also offers you many centralised tunings, like API Monitoring, Currencies Settings, Webhooks Control, Documents Approvals, etc.

Instead of going to 5-6 different administrative panels, you can change settings quickly from one place.

Instead of going to 5-6 different administrative panels, you can change settings quickly from one place.

Takeaways

1. The Fintech products can be cool, but only if they are simplified for the end-user. All great ideas that get financial profit for a user need a clear explanation of how they do so.

2. The aggregation of the different payment options needs a good UX layout representation. To reduce the pressure of the number of elements on the page.

3. Integration with 3rd party platforms can be tricky for users because of the number of redirects that he or they experience. The design should consistently articulate the current state and status of transactions.